Independent venture fire up cash is a profoundly sought after ware as an ever increasing number of individuals are taking a stab at independent work.

Measurably, the chances of independent venture fire up progress is under 20% inside a long term period.

A huge piece of the justification for getting your advance solicitation turned down, and the essential explanation new companies wind up falling flat in huge numbers in any case, is the mix-ups made when looking for financing.

Here are my best 7 independent venture startup cash looking for botches.

>>> Botch #1

No borrower hazard. The greatest single mix-up I see with individuals looking for startup capital is that they ask a moneylender for 100 percent of their capital necessities.

Hazard should be divided among borrower and loan specialist. Startup circumstances, contingent upon their inclination, commonly require the borrower to contribute somewhere in the range of 30% to half of the all out capital needed into the arrangement.

An individual value speculation lessens the expense of acquiring as well as gives some genuine skin into the arrangement that shows a solid responsibility in the interest of the borrower.

>>> Botch #2

Deliberate Business Plan. For most independent venture fire up cash, a field-tested strategy is a necessary piece of the application.

In a general sense, this is a significant prerequisite for somebody getting into any business. Tragically, most borrowers take a gander at this rigorously as a scholarly exercise to get financing with the main motivation behind finishing the marketable strategy being to fulfill a moneylender prerequisite.

A marketable strategy ought to be arranged all of the time according to the perspective that the essential promoter of the course of creation and readiness is the hidden business. On the off chance that this approach were taken all the more regularly, fire up circumstances would make more prominent progress, quicker.

>>> Botch #3

Helpless Working Capital Projections. Fire up circumstances will more often than not seriously center around the resources they need to obtain, the space they will rent, the leasehold improvement cost, and other starting consumption expenses needed to get the business going.

What will in general be either missed altogether or ineffectively assessed is the practical income needed to work the business until such time as the business can support itself on a month to month premise.

Part of the justification for this is a functioning presumption that the business will quickly be income positive in the principal month of tasks. As a rule this doesn’t occur, the shortages are financed by private Mastercards in view of the absence of arranged working capital, and the borrowers end up in Mastercard heck, paying exorbitant loan costs with possibly no chance to get out.

Sadly, making more sensible, and possibly moderate incomes might demonstrate that you need more cash to definitely begin, so the allurement is to be excessively hopeful to make the numbers work, which measurements show is an ill-conceived notion as a general rule.

>>> Botch #4

No Real Marketing Plan. For most retail and administration new businesses, the showcasing plan comprises of putting a few publicizing, offering a few fabulous opening specials, and pausing for a minute and sitting tight for the surge of clients. Promoting can be over the top expensive and in the event that you don’t have the foggiest idea what you’re doing, you can consume all your accessible money before long.

According to the lender’s perspective, they need you to have the option to obviously explain how you will treat why should function alongside the connected expenses. Loan specialists ordinarily are not truly adept at evaluating promoting plans, but rather they can almost certainly let know if one is missing or terribly inadequate/unreasonable.

Perhaps the most remarkable method for supporting your showcasing technique and related strategies is with composed requests or letters of interest, or letters of expectation to work with you once you open.

>>> Botch #5

No Rationale For Key Assumptions. Regardless of whether you have an arrangement and sensible income projections, part of being sound is articulating how you’re endeavoring to treat an intelligent and clear to comprehend design with the goal that somebody who doesn’t conceivably knows anything about you’re business can track.

On the off chance that a solicitation for independent venture fire up cash is intelligent and contains very much archived suppositions, it naturally stands apart from the pack.

Be sure about how you thought of every single number you address in your application bundle and why you feel they are pertinent to your business case.

>>> Botch #6

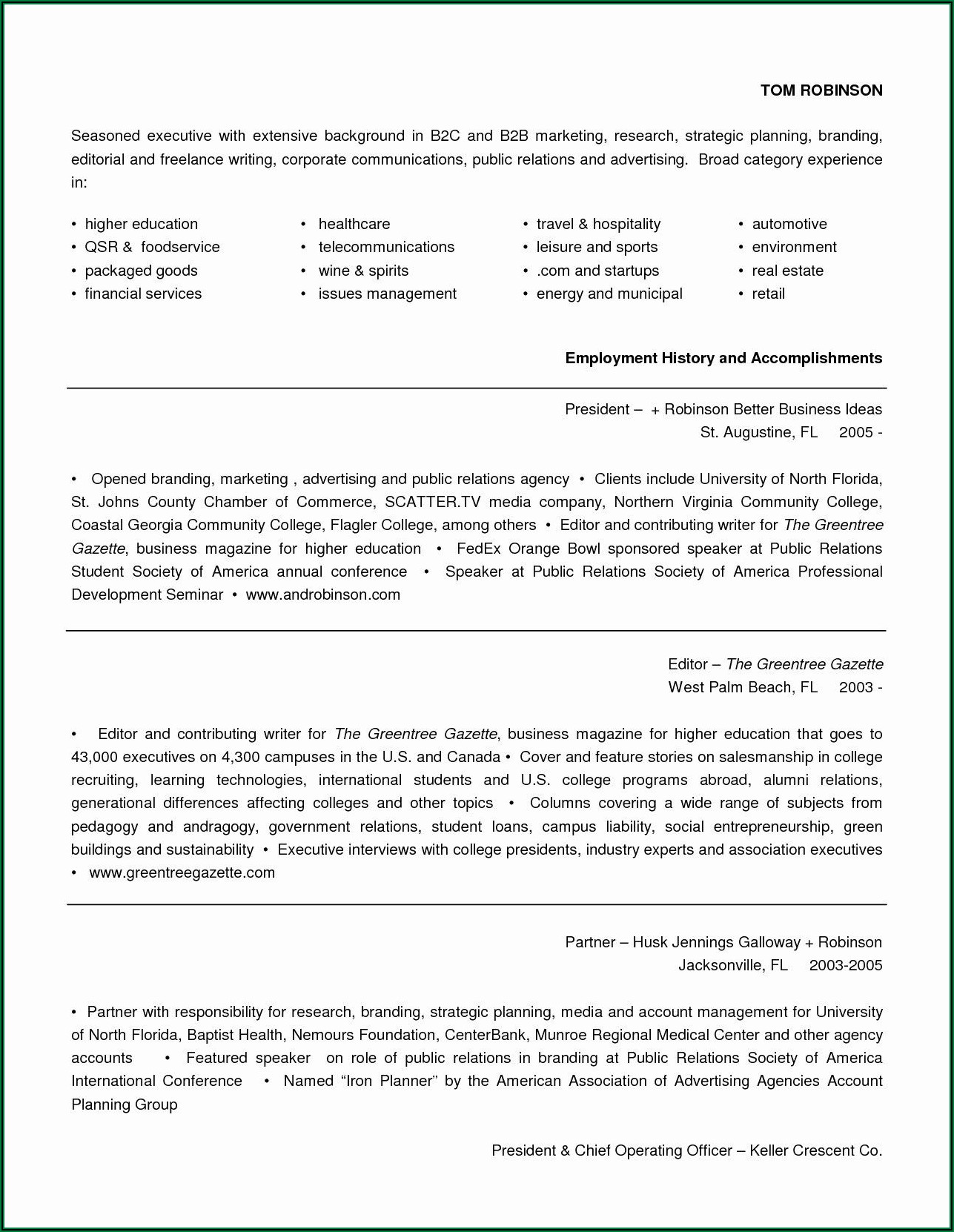

No Expertise and Support Team. One of the main inquiries that goes through any bank’s psyche when somebody finds out if the individual mentioning financing has the information, mastery, and backing to make the business fruitful.

Over and over again, people don’t record and support their own ability comparative with the undertaking. This should be possible through a resume, instances of past related work insight, letters of reference, a rundown of contacts that can give verbal reference, and so on

Outside of your own range of abilities, what sort of group have you gathered to help your endeavors? Much of the time, private ventures can begin without any representatives outside of the proprietor(s). Yet, you can in any case have a virtual group which can incorporate a bookkeeper, accountant, legal counselor, promoting mentor, innovation administration support, etc.

>>> Botch #7

Helpless Presentation. The conversations you have with a moneylender and the data you furnish to them either moves them with certainty or switches them off.

It might require a long time to get an advance endorsement, yet it can require only seconds to free any sensible opportunity to try and be truly thought of.

Outside of the undeniable requirement for great prepping, tidiness, and timeliness, the show interaction for the most part self-destructs in light of the fact that the moderator isn’t adequately ready to intrigue the hell out of the moneylender.

Yet, establishing a decent connection isn’t just about being excited and sure about your conveyance, its additionally about having the option to express the subtleties of how you’re attempting to treat why it would be a wise speculation for the loan specialist.

Over and over again, people looking for fire up reserves don’t plan ahead of time for their conversations with the moneylender and just “make things up along the way”, possibly obliterating any opportunity they may have needed to get the private venture fire up cash they were searching for.