If you are like most kiwi entrepreneurs, chasing down overdue accounts can be a time-consuming and frustrating nightmare you would rather not have to deal. This is right up there with the preparation of tax returns and firing employees.

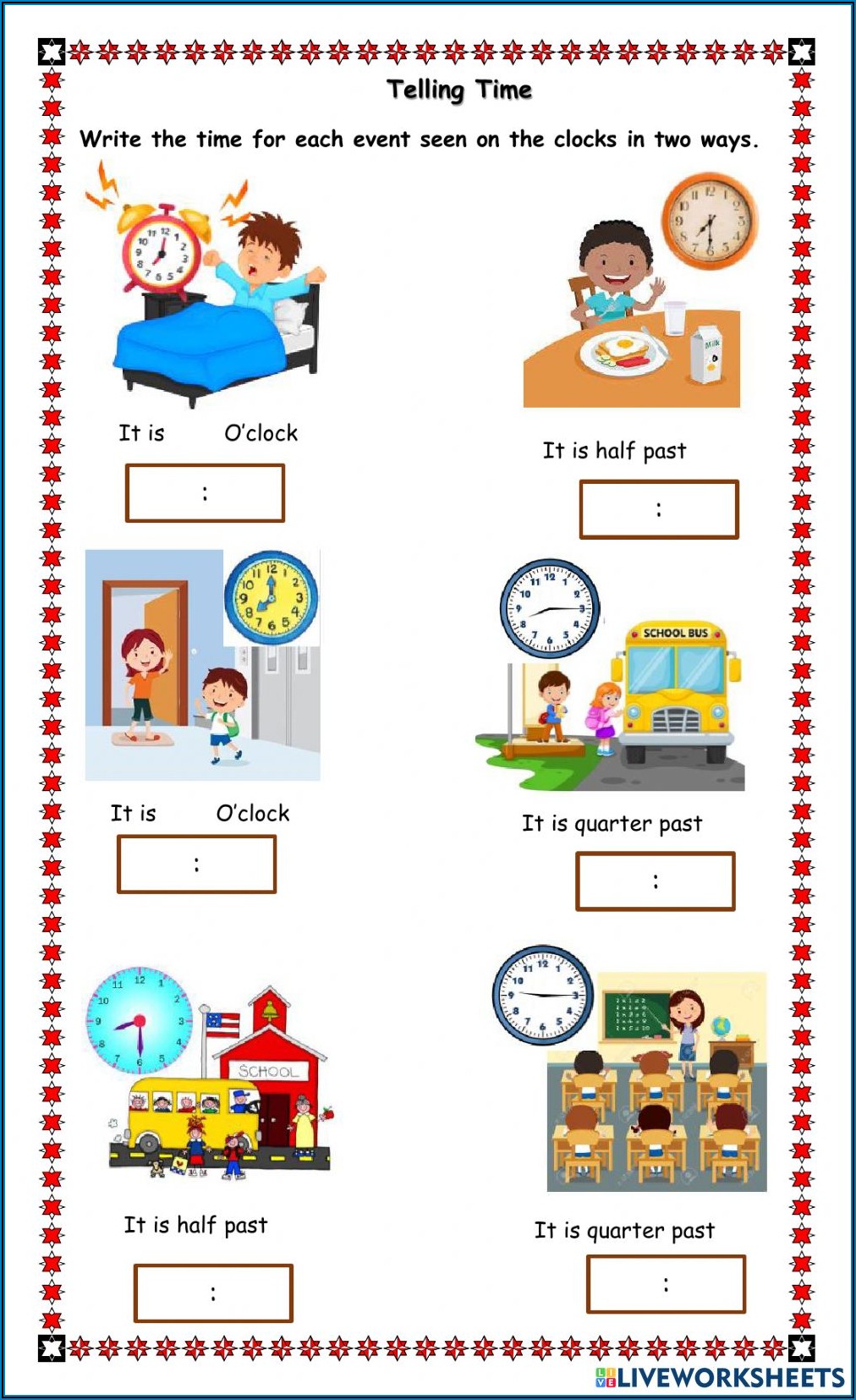

As horrible as it is to harass people for money, there are seven ways your overdue accounts could be killing your business.

7 Deadly Debt Drains That Bleed Life and Joy Out of Your Business

Communication Costs are

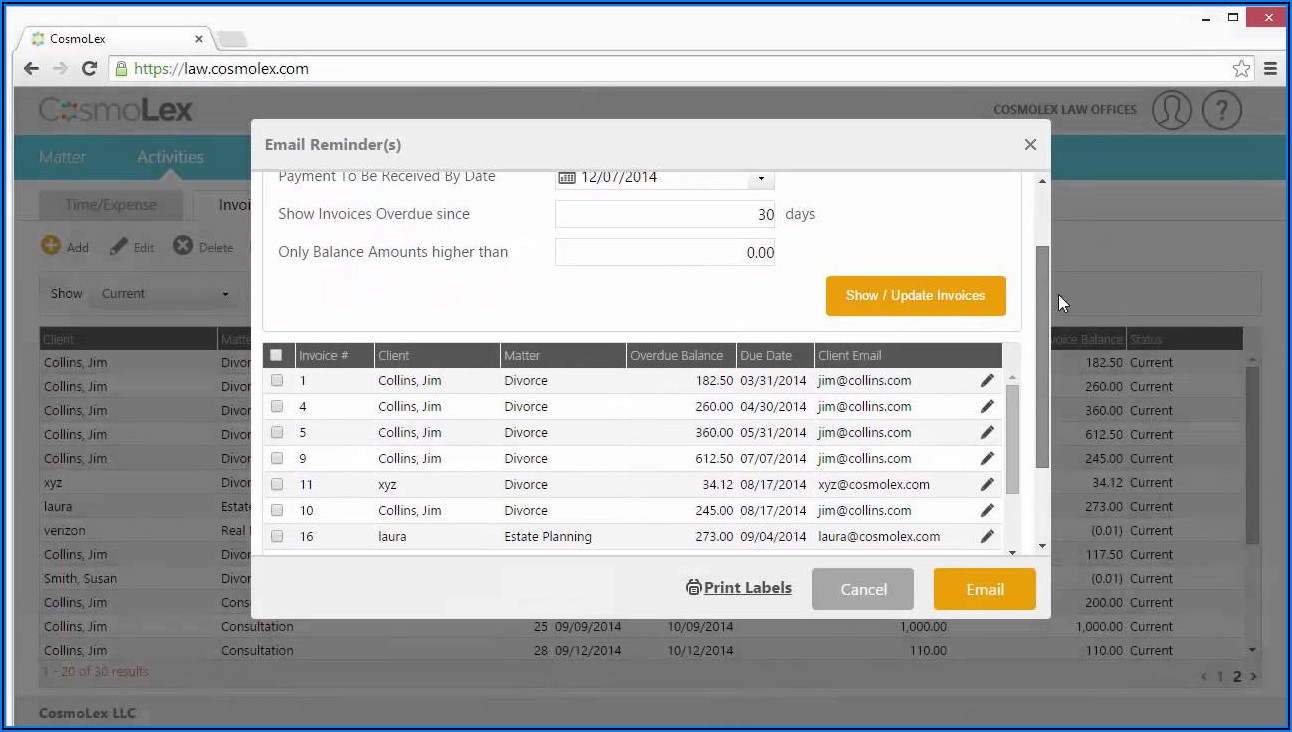

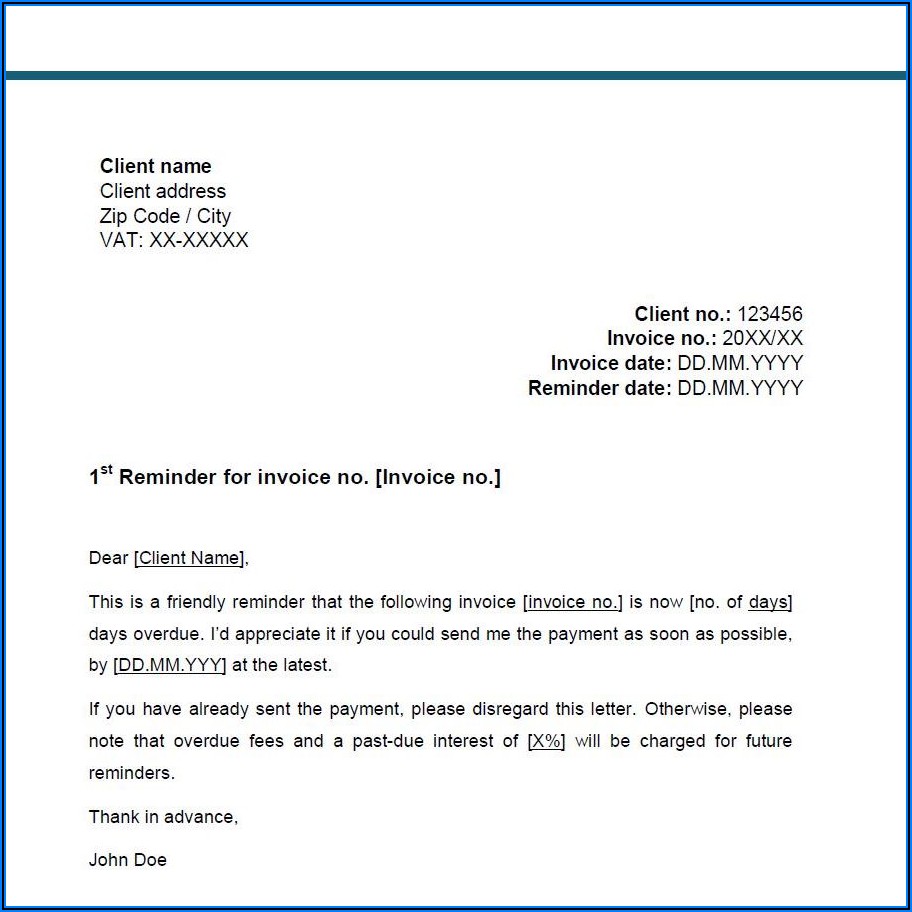

The actual cost of communicating with your creditors is the first cost to chase overdue accounts. There are three costs to chase overdue accounts: the paper, the printing, the stamps and the phone calls. These costs are like a drip from a tap. Each drop appears insignificant, but if left unchecked can drain your profits insidiously. Recently, a client wanted to cut back on expenses. He was shocked to find that he had spent $7,683.35 in direct communications costs to recover accounts past due. This did not include fees for debt collection agencies. It’s easy to ignore individual communication costs but they can eat into your profits year after year.

Employee Wages.

Businesses spend an average of 9.5 hours a week managing overdue accounts. This adds up to $5,928 per year, even if you pay someone $12 an hour. You’d be adamant that six grand is better spent on your wallet than on chasing bad debtors.

A Lost Opportunity.

Employee wages are not the only thing that is lost. This is because employees chase debtors instead of generating business. Imagine how much cash flow you would have if your staff spent nine and a quarter hours per week calling customers, cross-selling other products and services, and encouraging referrals. You’re wasting time and money by tying up employees who chase accounts.

Lost Productivity.

Also, each minute that you spend dealing with past due accounts is time you aren’t producing. As a business owner, your time should not be valued at $12 an hour. Your time is precious and you are the main money earner. You’re wasting hours on debt collection, which not only makes your hourly rate much higher than your employees’, but also means you are neglecting the most money-generating tasks. This is a huge cost to your company, and you can be certain it’s not incalculable.

Emotional Cost.

Except for a few very rare people, almost everyone hates the idea of chasing money. This is not surprising considering all the lies and abuse you are exposed to when dealing with them. This may sound like a fairy tale, but all that negativity, all that anger, frustration… all of it gets passed onto your accounts manager, which in turn can affect your business’ mood. Before you start to scoff, imagine that you are being verbally abused. You’ll feel upset and violated if you’re like most people. If you stay in this state, your performance, decision-making and relationships at work (and at home) will all be affected. If that’s how an abusive incident can affect your life, what does it do to someone who has to deal with this daily as part of their job every day? This is an expensive cost that’s almost impossible to quantify, but it doesn’t affect your profits at multiple levels every day.

Deadly Debt Drain

Cashflow is vital for every business. Without cashflow, your business won’t survive or thrive. Your cash-flows will be stifled by unpaid debtors, which in turn will impede your growth. This is another cost that is difficult to quantify but is very important. Having your money in unpaid accounts can cause havoc on your wealth and your financial security.

Un-Recovered Debt.

Uncollected debts can lead to income loss, which is the final hidden cost. Most business owners keep their debts too long. If there is one rule for debt recovery, it is that the longer you leave an account unpaid, the less likely it will ever be paid. Ineffectively chasing down debts in your house for months, sometimes even years is a waste of money. It may sound absurd, but it is a mathematical fact that failing a $1,000 loan recovery is equivalent to losing $12,500 in new business.

The Quick and Easy Solution

There is a silver lining to this story, so don’t get out of your car and start looking for a bridge. There is only root cause for all the loss in your business. This one cause can be quickly or easily eliminated in a single step.

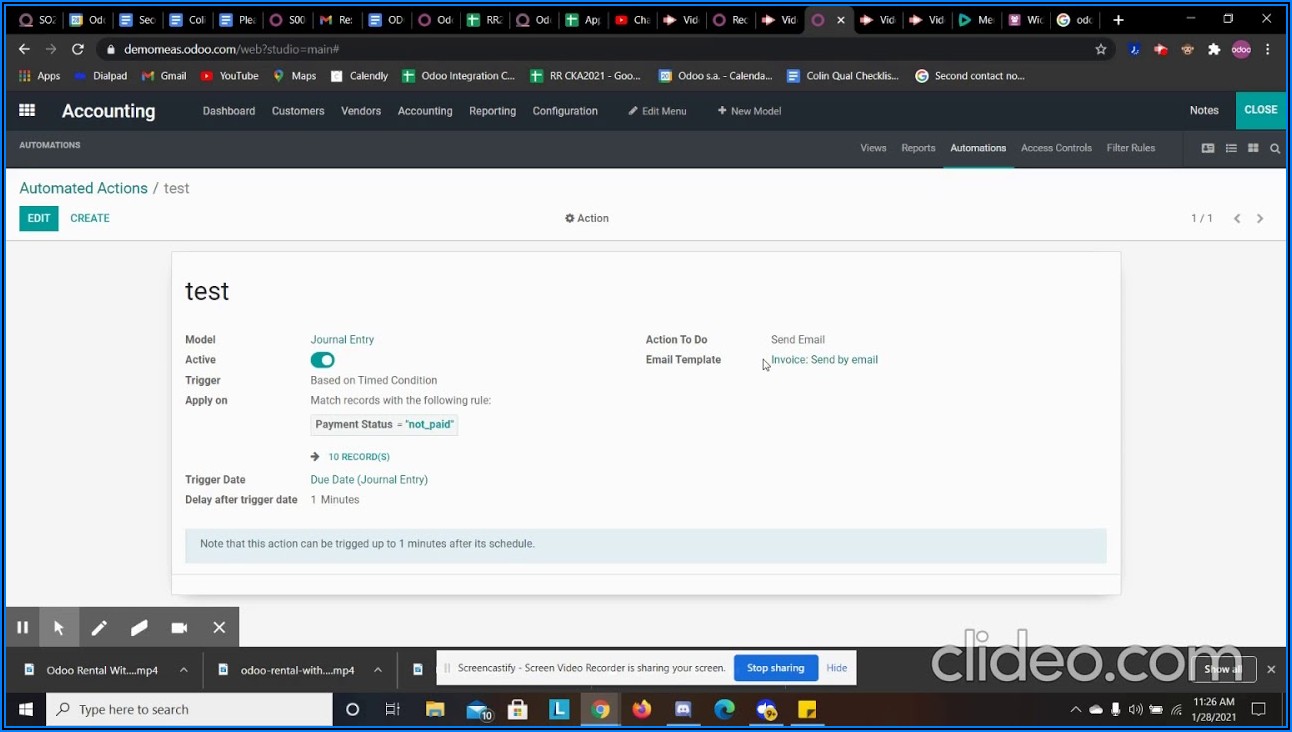

Is there a single source of this loss? The lack of a highly structured, powerful and efficient process for recovering debts. Don’t be discouraged if there isn’t one. It’s not your fault that you’re in the same boat with 99% of businesses. Who has ever taught you how to properly recover your accounts? You can eliminate the hidden costs and headaches that hold you back by creating a simple and affordable system for your business.