The best reimbursement possible with quick A/R processing in any healthcare facility requires attentiveness to gathering documents and communicating the information. From the moment a client plans a visit to the practice until the bill is closed out, the proper management of the information that flows to and from your billing agent is the difference between speedy reimbursed cycles as well as slow and dragged out A/R. Information on the insurance coverage, such as demographics, diagnosis, and status of claims being gathered from every aspect of your practice, should flow efficiently and clearly to enable a smooth claim submission the first time. Here are ten instances throughout the course of a patient’s visit that well-organized management of data can enhance the quality of your A/R.

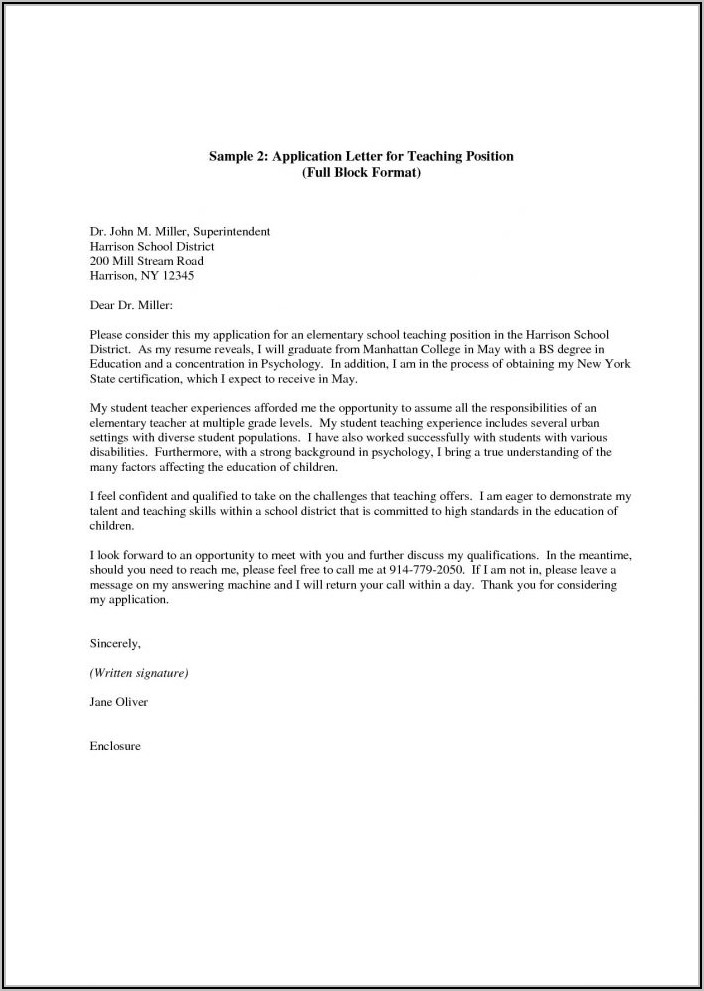

First Patient Contact

Front office personnel or the patient scheduling system should record all relevant information when patients call to set up an appointment. The capture of essential information such as name, number, and the reason for the appointment is a good starting point but be sure that you’re getting the correct information about payment as well. Do they have insurance? If yes, who is the insurer, and what’s the plan number? If they are not covered, is the company willing to pay upfront, as well as have they been informed about your payment policy? Whatever the case, responses to this question can assist in the verification step and establish the proper expectations regarding payment when the service is rendered.

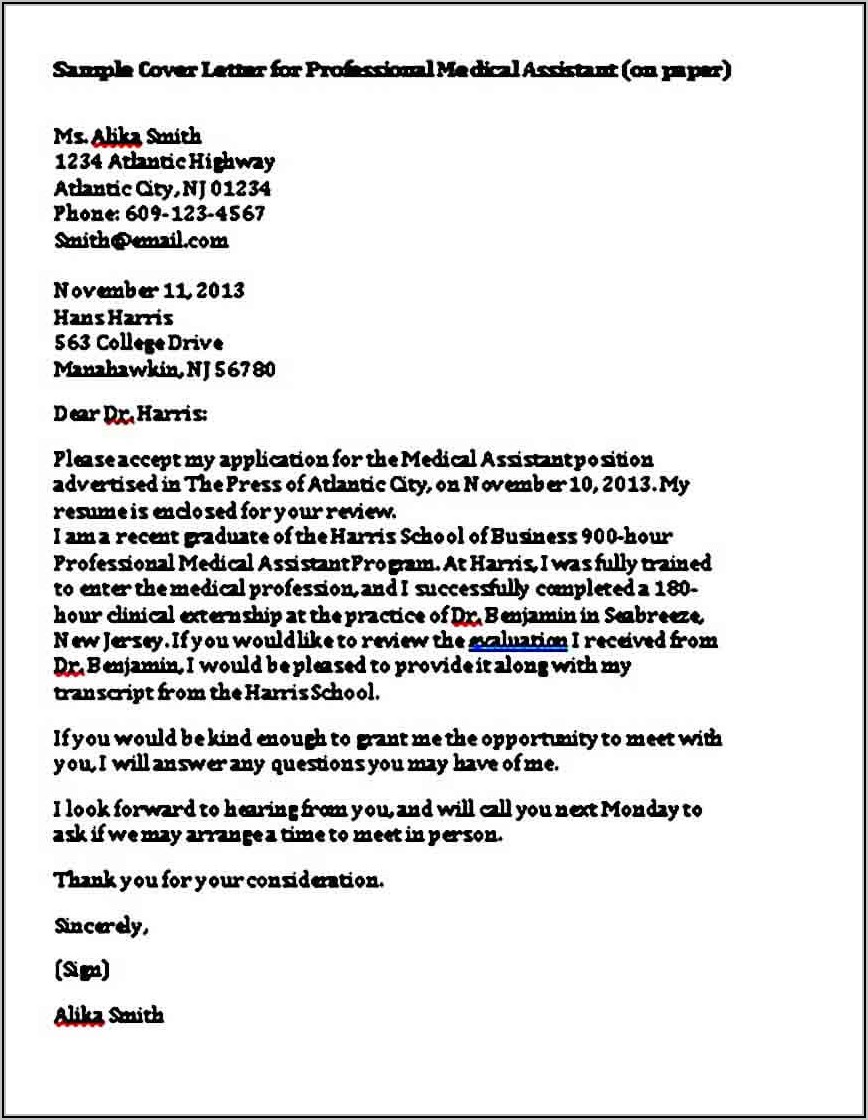

Insurance Verification

Either the scheduler or billing representative must use the initial information provided by the contact with the patient to verify with the carriers prior to the visit to the office. This is a chance to confirm the coverage level, co-pays/deductibles etc. The traditional method of verifying benefits by telephone is reliable, but it is time demanding; be aware that you could cut down on time using online interfaces offered by a variety of providers in the present. If the outcome is “no coverage” during this visit or the company cannot verify coverage, a follow-up call to the patient could result in updated coverage information or, at the very least, ensure that all parties are aware of their payment obligations.

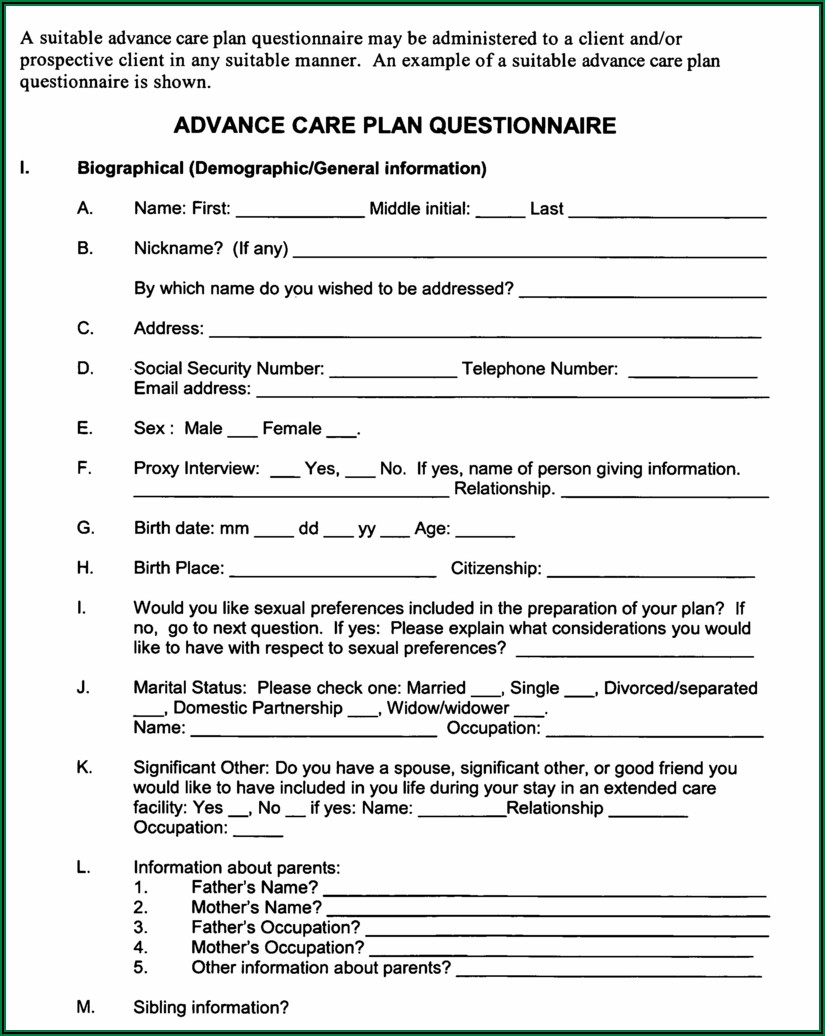

Patient Registration

Patient Registration If the patient is arriving in the office, the receptionist or staff member from the staff at the desk must check ALL patient registrations are valid and complete. If the patient is already a patient receptionist must confirm that the records are up-to-date. This is the most crucial step to obtaining and confirming the precise information needed for insurance claim submission. If anything is wrong or not present, reimbursements could be delayed by up to a month. It is also beneficial to have front desk personnel remind patients of their self-pay or co-pay obligations prior to the visit to ensure that the patient is willing to pay payments once the visit is completed.

Care and Document Services

When you are waiting in your examination room or shortly after the visit, every diagnosis and treatment must be recorded clearly on the encounter forms. Forms for patients are then sent back to the front of the clinic to cross-reference with the information collected at the time of insurance verification at step 2, and the invoice for co-pays or self-pay patients will be created.

Collect Co-payment

All patients must be required to visit the reception desk or cashier to pay for co-pays and self-pays, etc., prior to leaving. If all the steps preceding are correctly taken, the patient will be aware of their obligations, and there will be no unexpected surprises. A receipt may also be prepared now for the billing agent to record the exact amount remitted by the patient should the need for a balance bill later become needed.

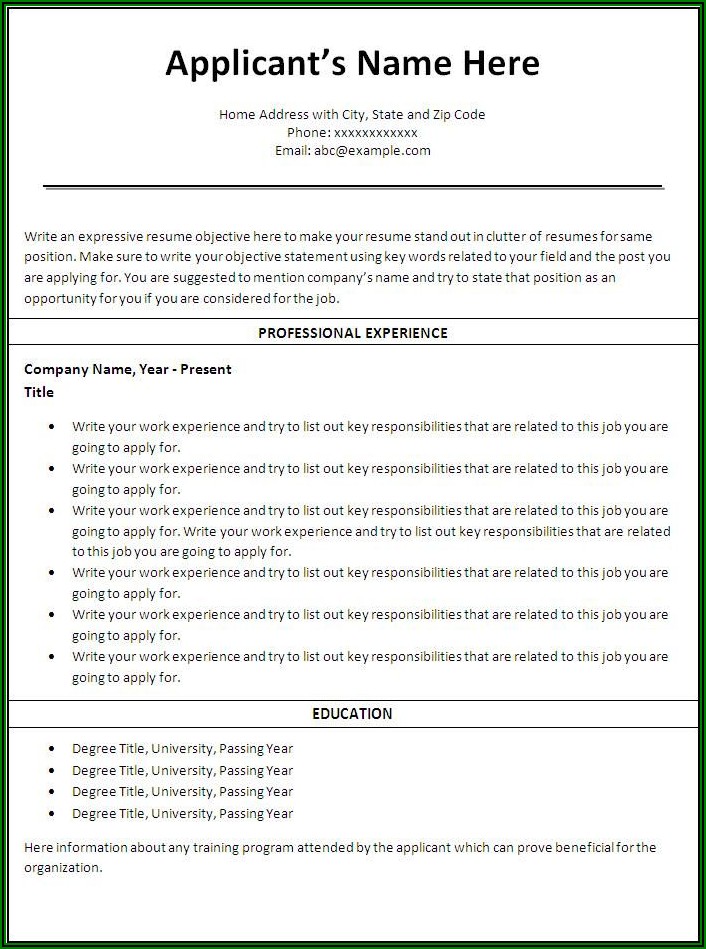

Claim Generation submission, as well as Carrier Review

Clean claim submission, is not only dependent on the data gathered during steps 1-5; however, it also depends on procedures that effectively manage data. A reliable medical billing or practice management software can address this need; however, keep in mind that you typically receive what you pay for, and it’s best not to make a mistake. Alternative to spending thousands of dollars on software is to team up with a reputable medical billing firm to receive, typically, only a tiny per cent of receivables. In either case, if the required data is not available at the time of claim submission, denial could delay the process of reimbursement. If everything goes well, the reimbursement process can begin within a matter of 1 or 2 weeks!

Insurance Reimbursement Documented or Received

It is likely that all the steps before have gone without a hitch, and a clear claim was filed. The next step in managing claim data is the correct documentation of reimbursements in the medical bill record. This process can be made more accessible by electronic remittances and EOB notifications. If you aren’t able to utilize electronic EOBs, it is crucial that the accounting representative is meticulous in recording the EOBs that are received. Monitoring your EOBs and their timing and reimbursement rates will help you determine the carriers that are paying more quickly and those that may need an additional phone call.

Patient Invoicing

Patient Invoicing This step concerns communicating with patients. Similar to carriers offering patients accurate details will also help decrease turnaround time and eliminate inquiries. Make sure to note when you received your service and the date, payments to insurance, as well as fees collected at the time of service and the amount due. These invoices must be issued when the insurance determination is made. Numerous statistics have demonstrated that the earlier an invoice is sent, the greater the likelihood and quicker the invoice to be paid.

Enter Payment Information for Patient

When the billing representative receives the patient’s payment, the billing representative needs to enter the payment details in the system for billing and then prepare to charge. If payment isn’t made within the requisite period in time (i.e. 30 days), The practice must be able to establish clear guidelines to determine the subsequent actions. Small balances say less than $5, could be considered a write off; for higher balances, an additional invoice may be issued, or the patient could be referred to a collection agency to take further actions. Whatever your policy, do not put off taking the necessary action. A/R is most affected when balances are not addressed and carried on month-to-month.

Closing Out Cost

After your final instalment has been made, or a decision was that it is time to erase or to send an invoice to collection agencies, your person who is in charge will not waste time closing the charge.

These techniques can be used for any patient encounter in nearly every speciality. If you’re a team of 20 or one person, keep these options in your mind when you think of methods to increase the efficiency of the information flow and also reduce your practice’s turnaround time for A/R.